When large projects can not have a margin for error, such as a chemical plant, an offshore oil rig, or a bridge supporting half a city, the selection of coatings is crucial. Industrial coatings are more than a surface finish; they are frequently the only defence against slow, costly deterioration of structural integrity. Selecting a supplier is not all about the best price or quick delivery. It is an action that will impact in the long term.

Businesses tend to hurry this search. They look through a couple of names on a catalogue, email a couple of people, compare prices quickly and then make a choice. But this shortcut way of thinking can cause actual problems. Not all coatings manufacturers are prepared to meet your requirements, and when the factors of technical support, long-term reliability and logistics are involved, it becomes a complex matter. There are corporations that are so good at speaking but are weak when the situation becomes tough or the deadline becomes short. Here we will get into details of some of the best methods to identify and evaluate suppliers of industrial coatings, not only concerning their product catalogues but in actual practice, performance, service and reliability.

How to Find Reliable Industrial Coating Manufacturers and Suppliers?

In those industries where the coating is more than a finish, where the coating is the main defence against corrosion, abrasion or chemical attack, then the dependability of the coating supplier will become a strategic choice. The wrong decision will result in schedule overruns, early material failure and expensive maintenance cycles. Businesses should adopt a formal method of searching and screening suppliers to eliminate these risks. This is achieved by adopting reliable sourcing means and by adopting clear criteria to determine the long-term suitability of each manufacturer or distributor.

How to Find Industrial Coating Suppliers

The first step is searching for coating manufacturing companies and distributors that genuinely cater to your project. Search engines are great, but you can’t depend on them only. You have to use reliable sources of general information to back yourself up, and it is especially vital to consult professional standards of review and conduct. If you are not sure how to do this, let us show you quickly how to find reliable industrial coating suppliers.

Industry Directories.

Industry-specific directories are a systematic and effective method of initiating the search for industrial coating suppliers. Such directories provided in industry publications or professional websites are usually structured according to supplier product type, market orientation and geography. Coatings Directory, Coatings World Supplier Directory, Paint & Coatings Industry (PCI) Magazine directory and PaintSquare coatings database are examples. These sites do not work like a normal search engine; instead, they present listings of businesses whose business credentials or associations are verified. They frequently contain specifications, datasheets, application profiles and contact details, so that buyers can easily find candidates that match the technical and commercial needs.

Trade Shows and Industry Events.

One of the most direct and informative ways of supplier evaluation is to attend trade shows. The American Coatings Show or the European Coatings Show are the events that unite the best manufacturers from around the globe and the region and present their new product lines, innovations, as well as the services offered. In addition to flipping through product catalogues, these shows allow face time with technical and salespeople. Guests are able to pose critical questions, seek demonstrations, and talk about bespoke solutions. Through such interactions, businesses can also assess the level at which a supplier is aware of certain industry issues and whether the supplier can offer customised support, something that cannot be well determined online.

Professional Associations and Technical Societies.

Membership of well-recognised industry associations can also be indicative of the validity or technical sophistication of a supplier. Professional associations like the Society of Protective Coatings (SSPC), NACE International (now AMPP), and ASTM International keep membership lists, standards databases, and certifications of both products and individuals. Suppliers involved in such networks have a greater chance of adhering to established industry practices and keeping in touch with the changes in regulation. These associations also conduct training sessions and issue peer-reviewed guidance that provide buyers with credible standards against which to evaluate suppliers against industry practice.

The 10 Best Industrial Coatings Companies In 2025.

Some things just have to work. A tank holding corrosive chemicals. A bridge that can’t afford to rust. A factory floor that sees forklifts all day, every day. These are the kinds of places where industrial coatings prove their worth or don’t. And behind every good coating, there is a company that makes sure it does what it is supposed to. 2025 has not made things easy. Headaches with raw materials, the increasing pressure of going green, and the ever-present stronger performance requirements are among the reasons why only the strongest coatings companies remain standing out. The largest ones, not those that just listen, deliver, and solve real-life issues.

Here our below list the companies that aren’t just keeping up, they’re leading. Because when the job is critical, you need more than a product. You need a partner who’s been there before and knows what it takes to make things last.

PPG Industries (Pittsburgh, PA, USA):

PPG is the giant of the industrial coatings world. When it requires paint and is durable, then chances are that PPG has a product to suit it. Their reach is enormous, even the bridges we drive over and the food cans we open up at home. They also lead in automotive and aerospace coatings, and have a very long tradition of research and innovation. What stands out lately is their serious push toward sustainability, developing coatings that protect without polluting.

PPG is the giant of the industrial coatings world. When it requires paint and is durable, then chances are that PPG has a product to suit it. Their reach is enormous, even the bridges we drive over and the food cans we open up at home. They also lead in automotive and aerospace coatings, and have a very long tradition of research and innovation. What stands out lately is their serious push toward sustainability, developing coatings that protect without polluting.

The Sherwin-Williams Company (Cleveland, OH, USA):

Sherwin-Williams is most well-known as a chain of stores selling paint; however, in the industrial sector, they are also very powerful players. They are experts at coating giant steel buildings, pipes, and vessels, and anywhere rust is the foe. It is their coil coatings that provide the buildings with a sleek, finished appearance, and their car refinishing systems are relied upon by body shops worldwide. What sets them apart is how complete their offering is; they don’t just sell coatings; they provide full solutions, backed by solid service.

Sherwin-Williams is most well-known as a chain of stores selling paint; however, in the industrial sector, they are also very powerful players. They are experts at coating giant steel buildings, pipes, and vessels, and anywhere rust is the foe. It is their coil coatings that provide the buildings with a sleek, finished appearance, and their car refinishing systems are relied upon by body shops worldwide. What sets them apart is how complete their offering is; they don’t just sell coatings; they provide full solutions, backed by solid service.

AkzoNobel N.V. (Amsterdam, Netherlands):

AkzoNobel unites European precision and global presence. They have developed a good reputation for sustainability, particularly in terms of powder coatings and marine paints, which minimise fuel consumption in ships. You can see their products on appliances, buildings, cars and even luxury yachts. The thing, however, that really sets them apart in 2025 is their leadership in green chemistry; they are not simply talking about low-VOC products, they are developing product lines based on eco-responsibility.

AkzoNobel unites European precision and global presence. They have developed a good reputation for sustainability, particularly in terms of powder coatings and marine paints, which minimise fuel consumption in ships. You can see their products on appliances, buildings, cars and even luxury yachts. The thing, however, that really sets them apart in 2025 is their leadership in green chemistry; they are not simply talking about low-VOC products, they are developing product lines based on eco-responsibility.

Axalta Coating Systems (Glen Mills, PA, USA):

Chances are, you have experienced the work of Axalta when you have sent a car to be repaired and were impressed by how well the colours of the vehicle matched. They are the worldwide leader in refinish coatings. However, that is only a certain part of their business; they also produce some of the strongest coatings available to buses, tractors and commercial vehicles. They are complemented by their technical expertise and an increasing focus on greener coatings, particularly in the areas of powder and e-mobility products.

Chances are, you have experienced the work of Axalta when you have sent a car to be repaired and were impressed by how well the colours of the vehicle matched. They are the worldwide leader in refinish coatings. However, that is only a certain part of their business; they also produce some of the strongest coatings available to buses, tractors and commercial vehicles. They are complemented by their technical expertise and an increasing focus on greener coatings, particularly in the areas of powder and e-mobility products.

BASF Coatings:

This coatings division is part of the chemical giant BASF, and they present some serious science to the table. They are one of the leading suppliers of car manufacturers and have the whole package: primers, clearcoats and high-gloss. They also supply the industrial and appliance markets with coatings based on profound chemical knowledge. Most recently, they have been in the news regarding restructuring, but they are still impactful and innovative, particularly where there is an overlap of chemistry and coatings.

Nippon Paint Holdings Co., Ltd.:

Nippon Paint has grown fast and smart, acquiring companies across the globe and expanding far beyond Japan. They are a real global player today, and they have operations in everything, including decorative paint, marine and protective paint. They have a massive network, and they have a reputation of reliable performance in industrial settings in Asia, Australia, and the Middle East. Their advantage is that they have balanced growth and local market expertise.

Nippon Paint has grown fast and smart, acquiring companies across the globe and expanding far beyond Japan. They are a real global player today, and they have operations in everything, including decorative paint, marine and protective paint. They have a massive network, and they have a reputation of reliable performance in industrial settings in Asia, Australia, and the Middle East. Their advantage is that they have balanced growth and local market expertise.

RPM International Inc. (Medina, OH, USA):

RPM is like a family of specialist brands, each one strong in its niche. Carboline handles extreme corrosion; Tremco keeps buildings watertight; Stonhard and Flowcrete lay down seamless, ultra-tough flooring. Together, they serve some of the most demanding sectors: chemical plants, energy facilities,and infrastructure projects. What you get with RPM is depth. They’re not generalists, they’re experts, and that shows in how long their coatings last under pressure.

RPM is like a family of specialist brands, each one strong in its niche. Carboline handles extreme corrosion; Tremco keeps buildings watertight; Stonhard and Flowcrete lay down seamless, ultra-tough flooring. Together, they serve some of the most demanding sectors: chemical plants, energy facilities,and infrastructure projects. What you get with RPM is depth. They’re not generalists, they’re experts, and that shows in how long their coatings last under pressure.

Jotun Group (Sandefjord, Norway):

Jotun has earned a strong reputation for protecting things in some of the harshest conditions on earth. The marine paints they produce enable vessels to travel more effectively, and their protective systems are relied upon on oil platforms, tankers, and heavy machinery. They are also producers of decorative and powder coatings, but what they are good at is durability. In tough conditions, Jotun is a name that is frequently thrown around first with a reason, as they have demonstrated that they can do it.

Jotun has earned a strong reputation for protecting things in some of the harshest conditions on earth. The marine paints they produce enable vessels to travel more effectively, and their protective systems are relied upon on oil platforms, tankers, and heavy machinery. They are also producers of decorative and powder coatings, but what they are good at is durability. In tough conditions, Jotun is a name that is frequently thrown around first with a reason, as they have demonstrated that they can do it.

Hempel A/S (Kongens Lyngby, Denmark):

The story of Hempel is of purpose and focus. They are pioneers in the marine and protective coatings, yet they are emerging as important players in the renewable energy market, particularly wind turbines. They have antifouling marine paints such as Hempaguard that minimize drag and enhance fuel economy. Hempel is not only competing, but with sustainability as the guiding principle, they are also evolving and investing in innovation and impact.

Kansai Paint Co., Ltd.:

Kansai may not make as many headlines as some others, but their reach is wide, especially in automotive and infrastructure. They supply both car makers and the refinish market, and they’re a go-to in regions like Africa, the Middle East, and Southeast Asia. Kansai also develops protective coatings for industrial steel, bridges, and buildings, often working quietly but effectively through partnerships and acquisitions. They’re growing steadily and smartly.

Each project is different and therefore what is required is ensuring that supplier capabilities match your technical, operational and environmental requirements to be successful. Whenever choosing a partner who is capable of supplying the right type of industrial coating, you should look at your own performance requirements, regulatory demands, and local factors like weather, application limitations and logistics. Making a considered, informed choice at this point will not only lead to a guaranteed performance of the coating, but will also foster an easier working of the project and cost savings in the longer term.

How to Evaluate and Select the Right Supplier?

After having a list of possible industrial coating suppliers, the next thing to be done is to establish the right supplier that can be relied on as a long-term partner. It is not just the comparison of datasheets; it needs to be a progressive assessment based on the technical compatibility and the business robustness. By slowing down and assessing your suppliers carefully, you can prevent such expensive mistakes as failure of products, irregular support or shipments.

Evaluation of industrial coatings suppliers

Product Quality:

The initial and closest requirement is the quality of the product, not only shown in the datasheets and marketing but also in test results and certifications done by a third party, which somebody can verify. All batches of high-quality coatings must share the same physical characteristics (film integrity, adhesion, corrosion resistance, chemical compatibility, etc.) despite the batch of production.

It is important to assess the existence of strong internal quality control systems by the supplier, such as raw material checking, in-process checks and final product checks. Part of the assurance that the supplier is complying with the established manufacturing practices is objective evidence of its compliance with global regulatory standards, such as ISO 9001 (quality management), REACH (European chemical safety), RoHS (hazardous substances), and others. Claims of product performance may be further validated by independent lab testing or site audits, where possible, particularly in mission-critical applications, such as aerospace, marine, or high-voltage electrical environments.

Technical Support:

The amount of technical assistance provided by the supplier is also crucial. Industrial coatings do not plug and play; their performance is likely to be sensitive to subtle conditions, including surface profile, humidity, curing time, compatibility with substrate, and environmental exposure. A good supplier must have a technically competent workforce that can offer pre-sales support, site training, and after-sales support. This may involve supplying bespoke formulations to deal with niche applications, assisting contractors with field application problems or giving guidance to specifiers on how to comply with the project-specific specification, such as NORSOK, ISO 12944 or SSPC/NACE guidelines. Within large industrial projects, access to skilled coating engineers or field service technicians may eliminate the threat of early coating failure or project delays. A supplier who plays an active role in helping applications to be successful beyond a basic role of providing a product is much more valuable.

Supply Capacity:

In addition to quality and support, another determining factor is the capacity to deliver coatings in a consistent and timely manner. Most of the industrial processes operate on lean time and rely on continuous supply chains. It is necessary to evaluate the production capacity of the supplier, its inventory management, geographical networks and delivery system. Its inventory management in case of repeat orders, whether they carry buffer stock of fast-moving products, and how they deal with a situation of lead time variation or emergency orders should be considered. A coating can be technically perfect, but never deliver reliably. When required anywhere where geographically scattered facilities are involved, the project can be delayed at great cost or have to undergo specification changes in mid-stream.

Adaptability to Your Business Needs:

lso, it is important to know how flexible the supplier is to your business requirements. Some suppliers provide modular service packages, custom labelling, co-branding or private formulations applicable to OEM or contractor markets. Others can also fit in with digital procurement systems, provide more thorough COAs (Certificates of Analysis), or automated re-order systems with high-volume customers. The supplier that is able to match operationally with your workflows, ERP systems, or forecasting models becomes an extension of your supply chain, as opposed to a transactional vendor.

Certifications and Customer Feedback:

Independent certifications serve as objective proof of a supplier’s quality management and environmental compliance systems. ISO 9001 is a baseline for quality, while ISO 14001 shows commitment to environmental management. Depending on the application, industry-specific standards such as NSF (for water contact), UL listings, or IMO approvals for marine use may also apply.

Beyond documentation, customer reviews provide practical insight into real-world performance. Direct referrals, third-party platforms like ThomasNet or Alibaba reviews (for international suppliers), or even LinkedIn industry discussions can offer honest feedback on service consistency, responsiveness, and after-sales behaviour. The trustworthiness of a supplier is best determined by having positive long-term customer relations.

The selection of a coatings supplier must not be a short-term transactional decision, but rather a long-term strategic decision. It demands a systematic method of exploration via dependable channels within the industry, and a multi-faceted assessment that is based on the basis of quality, support, providing abilities and reputation. A combination of directory research, attending events, associations, and a structured supplier vetting process will enable businesses to build supplier relationships that improve performance, minimise operational risks, and ensure regulatory compliance consistent among projects.

Define Technical and Commercial Criteria:

The process of evaluation is built on the definition of technical and commercial criteria. You will also need to determine how the coatings of each of the suppliers will perform in the set conditions that pertain to your industry or project. Things to be considered include durability, resistance to chemicals, adhesion and the cure times. Meanwhile, assess the compliance of their products with environmental and safety laws, like VOC levels, REACH compliance, or ISO certifications. In addition to product quality, take into consideration their technical guidance capacity, which includes application training, troubleshooting, or support at some point to assist in specification and surface preparation. The use of cost-effectiveness in terms of overall value must also be taken into consideration because the delivery schedules, flexibility in placing orders and providing continuous after-sales support can sometimes matter more than the price itself.

Ask for Samples and Test Data:

Once your shortlisting process is complete, it is now time to send out sample products and support test information. Experiencing what a coating will do in your real application environment is much more dependable than working with general specs. Put the sample in working conditions, either on an actual jobsite or on real or simulated job site conditions, and note how easy to work with that is, how it cures, the quality ofthe finish and how durable it is. Good suppliers will be able to and willing to present safety data sheets, technical documentation and results of performance tests that can assist them in making their claims.

Review References and Case Studies:

Another important thing is verifying sources and reviewing previous project case studies. Request every supplier to provide you with client references that have dealt with their products under similar circumstances. These discussions can also provide perspective on what it should be like to work with the supplier on a day-to-day basis, how quickly they react to requests to assist them, how reliable logistics are with them, and whether their products really do hit the mark in terms of use over a period of time. Moreover, you can also find some time and go through published case studies or testimonials that demonstrate how their products have fared in real-life uses. These would assure you that this supplier has encountered challenging or tricky coating problems before.

When you analyse a supplier of a coating, it is not only about choosing a product, but you are also dealing with creating a working relationship that will withstand the hard knocks of your industry. The appropriate partner will not only provide a high-quality covering but will also provide constant technical services, will offer to communicate openly, and will provide credibility in the long term.

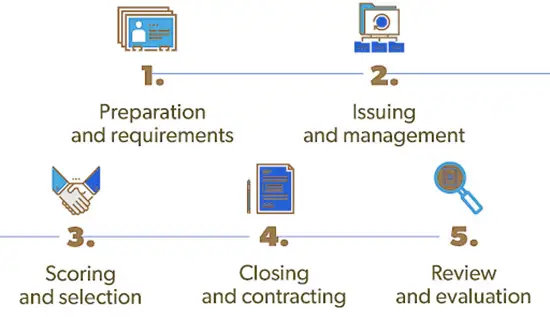

How Do I Submit An Industrial Coatings Quotation (Rfq)?

There’s a moment of pressure that comes just before sending out an RFQ, especially for something as technical and high-stakes as industrial coatings. It’s not just about asking for a price. It’s about opening a conversation with someone who could become a key part of a project’s success—or its failure. And that realisation often brings with it a quiet sense of responsibility: Did I include enough detail? Did I ask the right questions? Will they understand what I actually need?

Submitting a coatings RFQ isn’t complicated in the way a structural analysis might be. But it does require care. A thoughtful, well-prepared request can save hours of back-and-forth, avoid critical misunderstandings, and, perhaps most importantly, help ensure that the materials delivered will do what they’re supposed to when it matters most. Because let’s face it: if the wrong coating ends up on a bridge girder, a marine hull, or the inside of a chemical tank, the mistake can cost more than just money.

The best RFQs do one thing really well: they tell the supplier exactly what the project is, what’s expected from the coating, and when everything needs to happen. That’s where it starts.

How Do I Submit An Industrial Coatings Quotation

Begin with the Basics.

A good RFQ must start by giving a project overview. Not merely technical terminology or obscure names, but something human and sincere. As an example, this is to recoat a 30-year-old steel truss bridge in a coastal area where salt exposure is high. Just in that one sentence, a supplier can learn a lot about what to expect. It prepares the scene. It informs them that this is not ordinary steel; it is aged, perhaps corroded and subject to marine conditions.

Get Specific with Specifications.

This section may be a bit daunting, particularly to individuals who are unfamiliar with product codes or performance specs. However, transparency in this situation is everything. Provide any relevant standards that the coating should comply with ISO 12944, NORSOK M-501, SSPC or industry-specific. In case of a favourite system (e.g. primer + midcoat + topcoat), provide it explicitly. When you are not sure, just tell the truth. The finest suppliers will not exploit that; they will assist you in finding the appropriate system according to what you require.

And always tell what the coating is to do: resist abrasion, block UV, stand up to high heat, survive full immersion, etc. Coatings are means to an end, and suppliers can not advise the proper one unless they are aware of the end.

Quantity Isn’t Just a Number.

Adding an estimate of the quantity of product you will require demonstrates that you are serious–and assists suppliers in their quoting. It also provides them with an opportunity to raise any issues, such as whether your project would have concerns of exceeding shelf-life in storage or whether it would have to be delivered in phases. Break it down by system if possible: 1,000 litres of primer, 1,200 litres of midcoat, and 1,200 litres of topcoat, for instance. Don’t worry about being perfect; close estimates with context are far better than vague guesses.

Timelines Are Personal.

Deadlines matter. If you need the product by a certain date, say so. If you need submittals or technical approvals first, include that too. A rushed timeline isn’t the end of the world, but not mentioning it is. Let them know whether delivery is to a job site, a warehouse, or multiple locations. And if the schedule is tight because another part of the project slipped behind, be transparent. The human beings reading your RFQ have dealt with that too.

Include Contact Details That Invite a Conversation.

No one likes the feeling of sending a quote into a black hole. That’s why it’s so important to include a contact person who knows the project, not just a generic procurement inbox. Someone who can answer technical questions, talk through concerns, and respond in real time. RFQs that feel like conversations—not transactions—are almost always the ones that lead to better outcomes.

Attach What Matters—Drawings, Coating Maps, Site Photos.

It’s amazing how much a good reference photo can clarify. If you’ve got technical drawings, past coating specs, or site photos, include them. Suppliers will often spot things you didn’t realise were relevant. Maybe there’s a venting issue, or a problem with surface access, or a sign that flash rusting could be a real risk. Let them see what you see.

End with Clarity and Courtesy.

A simple closing paragraph, “We’re seeking a detailed quote that includes pricing, recommended system, TDS/SDS, and lead time for delivery”, makes it easier for suppliers to respond fully the first time. It shows you respect their time and effort. And always thank them. Not out of formality, but because someone is going to sit down, read your request carefully, and work hard to give you a solid answer.

| RFQ Element | What to Include |

|---|---|

| Project Overview | Description of what is being coated (e.g., structural steel in marine environment) |

| Substrate Material | Steel, concrete, aluminium, etc. |

| New or Maintenance | Specify if this is a new application or a recoat over existing systems |

| Required Standards | ISO 12944, NORSOK, SSPC, etc. |

| Expected Performance | Corrosion resistance, chemical resistance, abrasion durability, and UV exposure |

| Coating System | Preferred or required layers (primer, midcoat, topcoat) with thickness expectations |

| Estimated Quantities | Volume per layer (e.g., 1,000 L primer, 1,200 L topcoat) |

| Delivery Location | Address or site-specific delivery instructions |

| Timeline & Lead Time | Target delivery dates, urgency level, or phased delivery needs |

| Technical Contact | Name, phone/email of the person familiar with the job |

| Attachments | Photos, drawings, coating maps, old specs |

The industrial coatings industry is not merely about colour or surface appearance. It is a matter of security, effectiveness and collaboration. It does not matter whether you are finding a supplier, assessing technical standards, or writing a clear RFQ; each step counts. A failed coating can be much more costly to a business than the cost of money; it may jeopardise safety, slow down operations, and overburden reputations. But when you approach the process with clarity, structure, and real understanding, you build more than just a specification; you build trust. From exploring global directories to walking trade show floors and vetting technical certifications, this guide has laid out a path for finding not just any coatings supplier, but the right one. And once that supplier is identified, the RFQ becomes your handshake, your way of saying, “This matters to us, and we expect it to matter to you too.”And if you’re ready to take the next step, our website offers tailored conversion tools such as RFQ templates, supplier matching assistance, and technical support to help you move from research to action with confidence.

Do not risk that initial step. We can assist you in creating a well-defined, application-specific coatings sourcing plan that includes system suggestions, technical expertise and supplier advice to fit your application. Be it complicated conditions, short deadlines, or unknown specifications, we can help you transition between indecisiveness and assurance. Use the quick search feature of the coatingsdirectory platform, start with a free coatings project review and take the first step toward a reliable, performance-driven partnership.

FAQs

How big is the coating market?

The global paints and coatings industry is worth USD 194.5 billion in 2024 and is expected to grow to USD 227.5 billion by 2029 at a CAGR of 3.2% between 2024 and 2029. The global market of paints & coatings has been growing continuously, and this growth trend is expected to persist.

Who is the largest coatings company in the world?

This year, Sherwin-Williams took over PPG as the largest paint company worldwide, with a coatings sales volume of 18.4 billion dollars. Coatings World is proud to bring the industry our annual Top Companies Report – the only truly global ranking of the top manufacturers of paint and coatings.

How big is the epoxy industry?

In 2023, the global epoxy resin market size was estimated to be USD 12.74 billion, and it is expected to reach USD 21.37 billion by 2032 with a CAGR of 5.9% during the forecast period. In 2023, Asia Pacific controlled the epoxy resin market with a 68.76 per cent market share.